Manage Project Finances

Velora AI provides comprehensive financial management tools for your construction projects, including budget planning, vendor rate management, and cashflow tracking. This guide covers how to effectively manage your project finances using both the admin app and site app.

Overview of Financial Management

Three Core Components

1. Budget Management

- Create and manage project budgets with detailed categories

- Track planned vs. actual expenses

- Monitor budget variance and remaining amounts

- Link budgets to project phases and responsible parties

2. Vendor Rate Management

- Set and track vendor rates for materials, equipment, and labor

- Manage rate types (hourly, daily, per unit, fixed, lump sum)

- Track rate effectiveness periods

- Link rates to specific vendors and projects

3. Cashflow Management

- Record cash in and cash out entries

- Link cashflow to budget items

- Track payment modes and references

- Monitor net cashflow and project financial health

Access Levels

Admin/Owner Access:

- Full access to all financial features

- Can manage budgets, vendor rates, and cashflow

- Can view financial summaries and reports

Member Access (Edit Permission):

- Can manage cashflow entries

- Cannot modify/ view budgets or vendor rates

Member Access (View Permission):

- Can view cashflow entries

- Cannot modify/ view budgets or vendor rates

Budget Management

Creating Budget Items

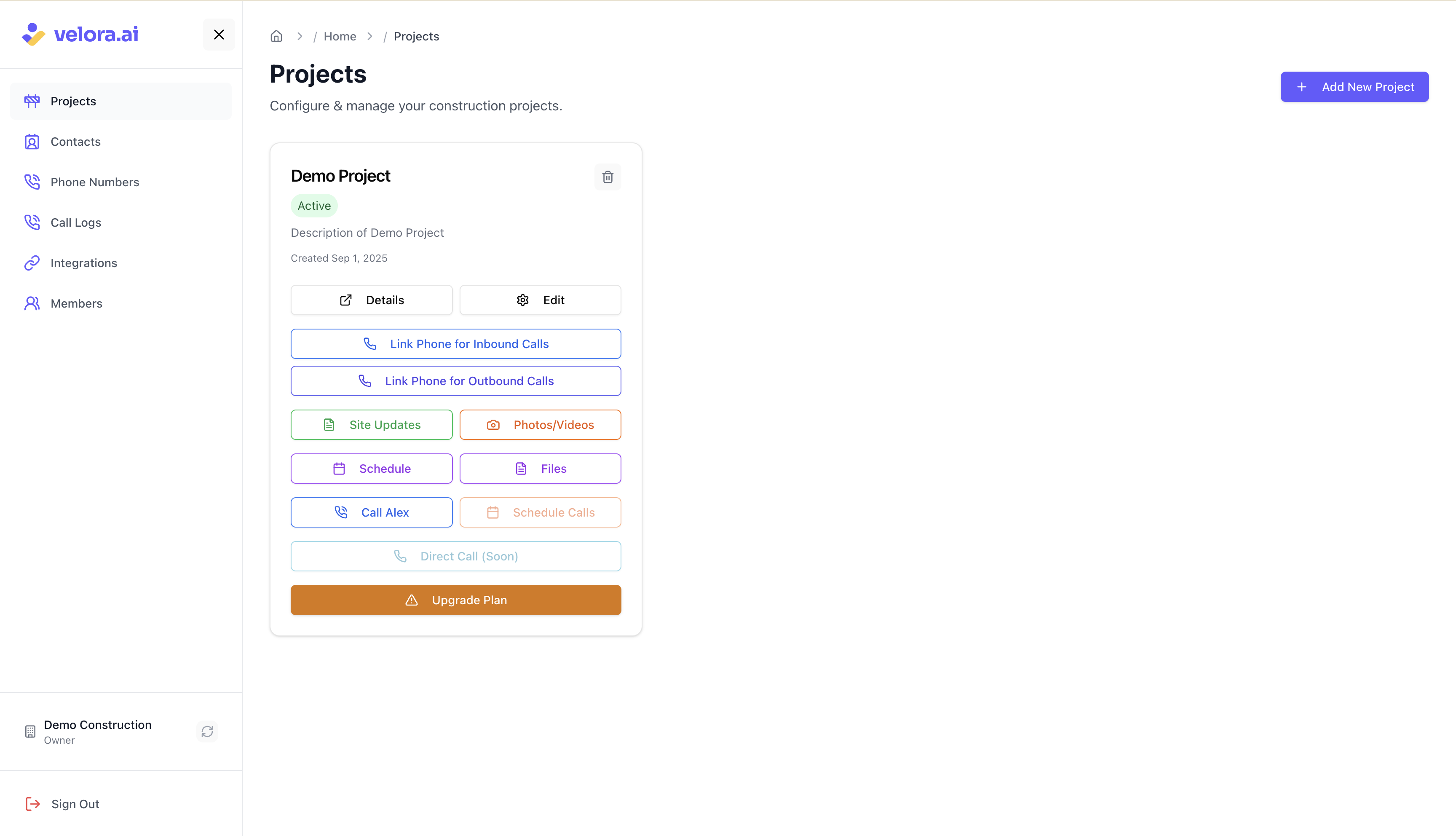

Step 1: Access Budget Management

- Navigate to projects tab in the admin app

- Click on the "Finances" button on the project card

- Select the "Budget" tab (available to admins/owners only)

Step 2: Add New Budget Item

- Click the "Add Budget Item" button

- Fill in the budget details:

Required Fields:

-

Category: Select from construction-specific categories:

- Site Preparation, Excavation, Foundation, Structural etc.

-

Planned Amount: Enter the budgeted amount for this item

Optional Fields:

- Sub-Category: More specific classification (e.g., "Concrete", "Steel")

- Budget Type: Direct Cost, Indirect Cost, Contingency, or Escalation

- Project Phase: Pre-Construction, Construction, or Closeout

- Responsible Party: Person or company responsible for this budget item

- Associated Contact: Link to a project contact

- Vendor: Link to a specific vendor

- Start/End Dates: Timeline for this budget item

- Status: Active, On Hold, Completed, or Cancelled

- Priority: Low, Medium, High, or Critical

- Notes: Additional information about the budget item

Step 3: Save Budget Item

- Review all information for accuracy

- Click "Create" to save the budget item

- The item will appear in your budget table with automatic calculations

Budget Tracking & Monitoring

Budget Summary Cards

The budget dashboard displays four key metrics:

Total Planned: Sum of all planned amounts across budget items Total Actual: Sum of actual expenses (from cashflow entries) Total Committed: Amounts released but not yet spent Total Variance: Difference between planned and actual amounts

Budget Table Features

- Category Display: Shows human-readable category names

- Sub-Category: Additional classification details

- Budget Type: Visual badges for different cost types

- Financial Tracking: Planned, actual, committed, and remaining amounts

- Variance Monitoring: Color-coded variance indicators (green for under budget, red for over budget)

- Status Tracking: Current status of each budget item

- Actions: Edit or delete budget items (admin/owner only)

Editing Budget Items

Step 1: Access Edit Mode

- Click the "Edit" button (pencil icon) next to any budget item

- The budget form will open with current values pre-filled

Step 2: Modify Information

- Update any fields as needed

- Changes are reflected immediately in calculations

- Click "Update" to save changes

Step 3: Monitor Impact

- Budget summaries update automatically

- Variance calculations reflect new values

- Related cashflow entries remain linked

Vendor Rate Management

Setting Up Vendor Rates

Step 1: Access Vendor Rates

- Navigate to "Finances" from your project card in Projects tab

- Select the "Vendor Rates" tab (admin/owner only)

Step 2: Add New Vendor Rate

- Click "Add Vendor Rate"

- Fill in the rate details:

Required Fields:

-

Vendor: Select from existing vendors or add a new one

-

Rate Type: Choose from:

- Hourly: Rate per hour of work

- Daily: Rate per day of work

- Per Unit: Rate per unit (sq ft, cubic yards, etc.)

- Fixed: Fixed price for specific work

- Lump Sum: Total price for complete scope

-

Rate: Enter the rate amount

-

Effective From: Date when this rate becomes effective

Optional Fields:

- Unit: Measurement unit (e.g., "sq ft", "hours", "cubic yards")

- Effective To: End date for this rate (leave blank for ongoing rates)

- Status: Active or Inactive

Step 3: Create New Vendor (if needed)

If the vendor doesn't exist:

- Select "Add new vendor" from the vendor dropdown

- Fill in vendor details:

- Vendor Name: Company or individual name

- Domain: Website domain (optional)

- Vendor Type: Material, Equipment, or Labor

- Click "Create Vendor"

- The new vendor will be available for rate setting

Managing Vendor Rates

Rate Table Features

- Vendor Information: Name and type of vendor

- Rate Details: Type, unit, and amount

- Effective Period: Start and end dates

- Status: Active or inactive rates

- Actions: Edit or delete rates (admin/owner only)

Rate Management Best Practices

- Regular Updates: Update rates as market conditions change

- Effective Dating: Use effective dates to track rate changes over time

- Vendor Categorization: Organize vendors by type (material, equipment, labor)

- Rate Documentation: Include notes for rate justification

Cashflow Management

Recording Cash In Entries

Step 1: Access Cashflow

- Navigate to the "Finances" tab

- Select the "Cashflow" tab

- Click "Add Cash In"

Step 2: Create Cash In Entry

-

Budget Item (Optional): Link to an existing budget item

- If linked, category and sub-category are automatically filled

- If not linked, manually select category and sub-category

-

Amount: Enter the cash in amount

-

Category: Select from budget categories (auto-filled if linked to budget)

-

Payment Mode: Choose from:

- Cash, Bank Transfer, UPI, Cheque, Card

-

Additional Information:

- Sub-category: More specific classification

- Reference Number: Invoice number, transaction ID, etc.

- Notes: Additional details about the cash in

Step 3: Save Entry

- Review all information

- Click "Add Cash In"

- Entry appears in cashflow table with timestamp

Recording Cash Out Entries

Step 1: Access Cash Out

- From the cashflow tab, click "Add Cash Out"

Step 2: Create Cash Out Entry

-

Link to Committed Cash-In (Optional): Connect to a previously recorded cash in entry

- Automatically fills category and sub-category

- Links the expense to the original budget allocation

-

Amount: Enter the expense amount

-

Category: Select expense category (auto-filled if linked)

-

Payment Details:

- Payment Mode: How the expense was paid

- Reference Number: Receipt number, invoice number, etc.

-

Additional Information:

- Sub-category: More specific expense classification

- Project Contact: Link to a project contact if applicable

- Notes: Additional expense details

Step 3: Save Entry

- Verify all information is correct

- Click "Add Cash Out"

- Entry appears in cashflow table

Cashflow Monitoring

Summary Cards

The cashflow dashboard shows three key metrics:

Total Cash In: Sum of all cash in entries

Total Cash Out: Sum of all cash out entries

Net Cashflow: Difference between cash in and cash out (positive = profit, negative = loss)

Cashflow Table Features

- Date Tracking: When each entry was recorded

- Type Indicators: Visual badges for cash in (green) vs cash out (red)

- Category Information: Main category and sub-category

- Amount Display: Formatted currency amounts

- Payment Details: Mode and reference information

- Contact Information: Associated project contacts

- File Attachments: View and download attached receipts/documents

Date Filtering

Use the date filter dropdown to view cashflow for specific periods:

- Today: Current day's entries

- Last 7 days: Past week

- Last 30 days: Past month

- All time: Complete project cashflow history

File Management

Attaching Files

- When recording cashflow entries, you can attach supporting documents

- Supported file types: Images (JPG, PNG, GIF, WebP), PDFs, and other documents

- Files are securely stored and linked to specific cashflow entries

File Operations

- Preview: Click the eye icon to preview files in a modal

- Download: Click the download icon to save files locally

- View: Images and PDFs can be viewed directly in the browser

Site App Cashflow Management

Mobile Cashflow Recording

Accessing Cashflow on Site

- Open the site app on your mobile device

- Select your project from the dropdown

- Navigate to the "Cashflow" tab

Recording Expenses on Site

- Quick Entry: Tap "Add Cash Out" for immediate expense recording

- Photo Capture: Take photos of receipts directly with your device

- Category Selection: Choose from the same categories as the admin app

- Amount Entry: Enter expense amount with mobile-friendly interface

- Save: Entry is immediately synced to the project

Benefits of Mobile Recording

- Real-time Recording: Capture expenses as they happen

- Receipt Photos: Take photos of receipts for documentation

- Offline Capability: Record entries even without internet connection

- Instant Sync: Data syncs when connection is restored

Financial Reporting & Export

Export Options

CSV Export

- From the cashflow tab, click "CSV" button

- Download includes all cashflow entries for the selected period

- Can be opened in Excel or other spreadsheet applications

PDF Export

- Click "PDF" button for formatted report

- Includes cashflow summary and detailed entries

- Professional format suitable for client reporting

Financial Analysis

Budget Performance

- Variance Analysis: Compare planned vs. actual expenses

- Category Breakdown: See which categories are over/under budget

- Trend Analysis: Track spending patterns over time

Cashflow Health

- Net Position: Monitor overall project profitability

- Cash Flow Trends: Identify spending patterns and cash flow issues

- Payment Tracking: Monitor payment modes and timing

Best Practices for Financial Management

Budget Planning

- Detailed Categories: Use specific categories for better tracking

- Realistic Estimates: Base budget amounts on market research and historical data

- Contingency Planning: Include contingency amounts for unexpected costs

- Regular Reviews: Update budgets as project scope changes

Vendor Management

- Rate Documentation: Keep detailed records of rate changes

- Vendor Performance: Track vendor reliability and quality

- Market Monitoring: Regularly review rates against market conditions

- Contract Terms: Document rate validity periods and terms

Cashflow Management

- Timely Recording: Record expenses as they occur

- Receipt Management: Always attach supporting documentation

- Regular Reconciliation: Match cashflow entries with bank statements

- Cash Flow Forecasting: Use historical data to predict future needs

Security & Access Control

- Role-Based Access: Ensure only authorized personnel can modify budgets

- Audit Trail: All financial changes are logged with timestamps

- Data Backup: Financial data is automatically backed up and secured

- Compliance: Follow industry standards for financial record keeping

Troubleshooting Common Issues

Budget Issues

Problem: Budget variance showing incorrect amounts Solution: Check that cashflow entries are properly linked to budget items

Vendor Rate Issues

Problem: Vendor not appearing in rate creation Solution: Create the vendor first using "Add new vendor" option

Problem: Rate not showing as active Solution: Check effective dates are set properly

Cashflow Issues

Problem: Cash in/out buttons disabled Solution: Check user permissions - only users with edit access can add entries

Problem: File upload not working Solution: Check file size and format - ensure file is under size limits and in supported format

Getting Help

Support Resources

- Documentation: Refer to this guide for detailed instructions

- Support Team: Contact support@velora.ai for technical assistance

Additional Resources

- Quick Start Guide: Learn the basics of project setup

- Team Management: Understand user roles and permissions

- Access Control: Learn about security and data protection

- Site App Guide: Master mobile project management

Effective financial management is crucial for construction project success. Velora AI's comprehensive financial tools help you track budgets, manage vendor relationships, and monitor cashflow to ensure your projects stay on track and within budget.